Tax Planning

-

Don’t ignore state-level tax implications in planning06/15/2025

Don’t ignore state-level tax implications in planning06/15/2025 -

Use qualified charitable distributions after age 70½06/12/2025

Use qualified charitable distributions after age 70½06/12/2025 -

Make tax planning a monthly habit, not a last-minute scramble06/09/2025

Make tax planning a monthly habit, not a last-minute scramble06/09/2025 -

Understand the gift tax limits before transferring wealth06/05/2025

Understand the gift tax limits before transferring wealth06/05/2025 -

Leverage 529 plans for future education funding06/03/2025

Leverage 529 plans for future education funding06/03/2025 -

Track business expenses in real time to maximize deductions05/30/2025

Track business expenses in real time to maximize deductions05/30/2025 -

Defer bonuses or income when possible to lower brackets05/28/2025

Defer bonuses or income when possible to lower brackets05/28/2025 -

Use tax-advantaged accounts for healthcare expenses05/26/2025

Use tax-advantaged accounts for healthcare expenses05/26/2025 -

Avoid surprise taxes from mutual fund distributions05/21/2025

Avoid surprise taxes from mutual fund distributions05/21/2025 -

Plan for estimated quarterly taxes if self-employed05/18/2025

Plan for estimated quarterly taxes if self-employed05/18/2025 -

Review your withholding settings every new tax year05/15/2025

Review your withholding settings every new tax year05/15/2025 -

Separate investment accounts by tax treatment05/13/2025

Separate investment accounts by tax treatment05/13/2025 -

Time charitable donations for optimal tax impact05/08/2025

Time charitable donations for optimal tax impact05/08/2025 -

Know the difference between tax deferral and tax elimination05/04/2025

Know the difference between tax deferral and tax elimination05/04/2025 -

Bundle deductions for greater itemizing potential04/29/2025

Bundle deductions for greater itemizing potential04/29/2025 -

Use a Roth conversion ladder to spread tax liability04/24/2025

Use a Roth conversion ladder to spread tax liability04/24/2025 -

Understand how capital gains are calculated04/22/2025

Understand how capital gains are calculated04/22/2025 -

Harvest losses strategically before year-end04/17/2025

Harvest losses strategically before year-end04/17/2025 -

Reduce your taxable income using retirement contributions04/15/2025

Reduce your taxable income using retirement contributions04/15/2025

Latest Articles

-

08/28/2025Investors turn to defensive stocks ahead of policy meeting

08/28/2025Investors turn to defensive stocks ahead of policy meeting -

08/25/2025Be cautious of chasing yield at the expense of safety

08/25/2025Be cautious of chasing yield at the expense of safety -

08/25/2025US manufacturing data surprises to the upside

08/25/2025US manufacturing data surprises to the upside -

08/25/2025Let market volatility work for you—not against you

08/25/2025Let market volatility work for you—not against you -

08/22/2025Markets shrug off political uncertainty

08/22/2025Markets shrug off political uncertainty -

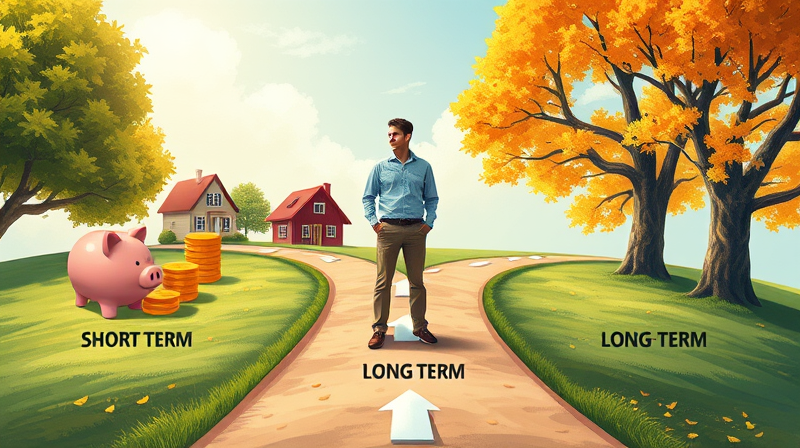

08/21/2025Match investment duration with financial goals

08/21/2025Match investment duration with financial goals